BY

|

Weekly Tax Table 2025–26: How Much Tax Comes Out of Your Weekly Pay?

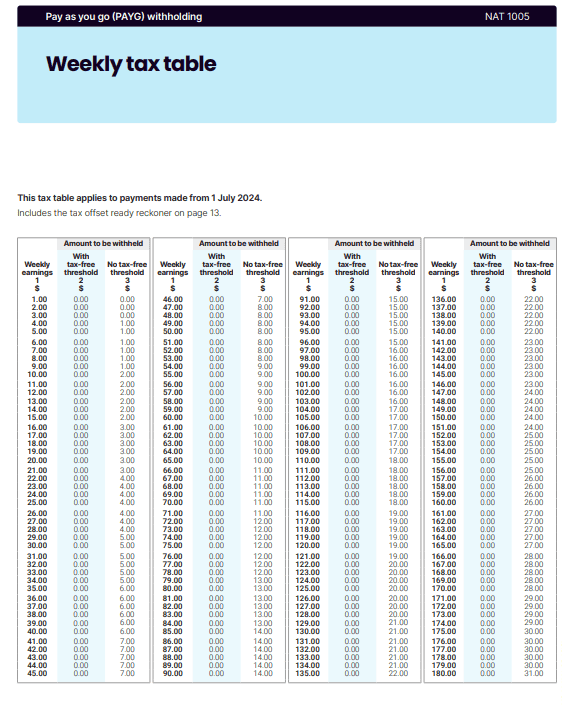

The weekly tax table is the ATO’s tool for working out how much PAYG withholding your employer takes from your weekly wages each pay cycle. The amount withheld is calculated using the ATO’s weekly tax table, based on the employee’s week’s pay.

This means your PAYG withholding is calculated according to your week’s pay as referenced in the ATO’s weekly tax table. It’s not your final tax bill—it’s an estimate based on the assumption that this week’s pay continues all year. Understanding how the table works and where it commonly goes wrong will help you avoid nasty year-end surprises.

Introduction to Tax Tables

Discover the hidden gem of Australia’s payroll world—tax tables are absolutely the backbone of the PAYG withholding system! These beautifully straightforward tools give you everything you need to calculate the perfect amount of tax to withhold from payments made to your employees and other payees.

The Australian Taxation Office (ATO) has designed each tax table to match your specific pay period—whether that’s weekly, fortnightly, or monthly—so the amount of tax withheld lines up perfectly with how often your employees get paid.

Why not rely on these fantastic tables to determine exactly the right tax to withhold from each payment? They’re designed to help spread your employees’ income tax obligations evenly throughout the year, and trust me, using the correct, up-to-date ATO tax table is absolutely essential for calculating withholding amounts accurately.

You’ll avoid those pesky under- or over-withholding situations that nobody wants! The tables get updated regularly to reflect changes in tax rates or legislation, so you’ll want to always grab the latest version published by the ATO—it’s worth every bit of effort.

Whether you’re processing payroll for weekly wages or making payments to other payees, following the ATO’s tax tables ensures that the perfect amount of tax gets withheld and reported every single time. This doesn’t just keep your business beautifully compliant—it also helps your employees avoid those unwanted surprises at tax time, and who doesn’t love that peace of mind?

Quick Answer – What Does the Weekly Tax Table Say for Your Pay?

The ATO weekly tax table is a grid of gross weekly earnings matched to the amount of tax that should be withheld under PAYG. Employers and payroll teams use it to calculate what comes out of each employee’s pay.

For example, if you earn around $1,000 per week and claim the tax-free threshold, the table shows roughly $170–$180 in weekly tax withholding. If you don’t claim the tax-free threshold—common for second jobs—that same $1,000 per week will have closer to $320 withheld. These are illustrations only; always check the current ATO weekly tax table or use the ATO’s tax withheld calculator for your exact situation. The table provides the exact withholding amount for each week’s pay based on your earnings and tax status.

The table is updated each income year and sometimes mid-year if tax rates change, so using last year’s version can leave you over- or under-withheld.

Note: Always use the most current version of the ATO’s weekly tax table to ensure your withholding amount is accurate.

Weekly Tax Tables in Plain English (and How They Fit Into PAYG)

PAYG withholding spreads your annual income tax bill across the year by taking a slice from each pay. The ATO publishes separate tables for weekly, fortnightly, and monthly pay periods, including specific monthly tax tables, all built from the same annual tax scales but scaled to match how often you’re paid.

Employers must use the table that matches the actual pay frequency. The ATO updates the following tax tables each year to ensure accurate withholding for payments made on a weekly basis, fortnightly, or monthly. Using the wrong table skews the withholding calculation and can create big tax bills or refunds at year-end. The weekly table assumes 52 pays per year, the fortnightly table assumes 26, and the monthly table assumes 12.

Each table has two main columns: one for employees who claim the tax-free threshold on their TFN declaration, and one for those who don’t. Extra tables or adjustments apply for employees with HELP/STSL debts, foreign residents, or those claiming tax offsets.

How to Read the ATO Weekly Tax Table Step by Step

The weekly tax table is structured as rows of gross weekly earnings and columns for tax-free threshold choices:

- Find the gross weekly pay row – This is the employee’s total earnings before any deductions.

- Pick the correct column – If the employee claims the tax-free threshold, use the left column; if not, use the right column.

- Read across to find tax withheld – The dollar figure at the intersection is how much PAYG tax to withhold this week.

- Apply special adjustments – If the employee has a HELP or other study loan, use the separate study and training support loans weekly tax table. Foreign residents and no-TFN scenarios also have their own tables with higher withholding rates.

- Calculate net pay – Subtract the tax withheld from gross pay to arrive at take-home pay.

Example: An employee earns $1,200 gross per week and claims the tax-free threshold. The 2025–26 weekly tax table shows around $218 in tax withheld, giving net pay of $982 before other deductions. If that same employee did not claim the tax-free threshold (say, it’s a second job), the table shows roughly $390 withheld, dropping net pay to $810.

Tax Offsets and Adjustments

You know what can really shake things up with your employee’s pay? Tax offsets and adjustments – and trust me, they’re a game-changer! Take something like the Low and Middle Income Tax Offset (LMITO) – this little beauty directly slashes the amount of income tax your employees need to pay, which totally changes how much tax you’ll need to withhold from each paycheck.

You’ll want to get clued up on any tax offsets your team’s entitled to and make sure you’re applying them just like the ATO wants you to, so you’re not left scratching your head wondering why the numbers don’t add up.

But wait, there’s more! You’ve also got to think about those Medicare levy adjustments and the Medicare levy surcharge that might pop up. Now, the Medicare levy’s usually already baked into your standard withholding calculations, but here’s the thing – some of your employees might qualify for reductions or even complete exemptions, and that’s going to mess with your withholding amounts in a good way.

And don’t forget about that Medicare levy surcharge – it’s gunning for the higher earners who haven’t sorted themselves out with private health insurance, and it’ll definitely throw another spanner in the works for your tax withholding calculations.

Here’s the deal though – you absolutely must keep your finger on the pulse with the latest ATO guidance on all these tax offsets and adjustments, because if you stuff this up, you’re looking at some pretty messy withholding errors that nobody wants to deal with.

Stay on top of things and follow the right procedures, and you’ll nail it every time, making sure the perfect amount of tax gets withheld. Your employees will thank you for it too – no nasty surprises come tax time, no unexpected bills, and no massive refunds that make them wonder what on earth happened during the year!

Support and Loans

Discover how study and training support loans, like HELP (Higher Education Loan Program) and VSL (VET Student Loans), are absolutely essential when you’re figuring out how much tax to withhold from your employee’s pay!

When you’ve got an employee with a study or training support loan, you’ll want to dive into those handy ATO tax tables or calculators to nail down the perfect withholding amounts. These fantastic support loans actually bump up the tax withheld to help cover your employee’s loan repayments, and it’s all based on their taxable income – pretty neat, right?

But wait, there’s more you’ll want to consider! Don’t forget about other taxable income gems like reportable fringe benefits and reportable super contributions – these little treasures can really shake things up when it comes to the total tax you need to withhold.

Calculating withholding amounts accurately in these situations can get a bit tricky, so why not reach out for professional advice if you’re feeling a bit lost? There’s no shame in getting some expert help! Getting those calculations spot-on means you’re keeping cosy with ATO requirements and helping your employees dodge any nasty surprise tax bills related to their support loans or other taxable income.

This Week’s Tax Is Not Your Real Tax Rate

The weekly tax table assumes this week’s earnings continue all year. If you work overtime or get a bonus in one week, the table treats it as if you’ll earn that higher amount every week, pushing withholding into a higher bracket, or tax bracket.

This is a timing issue, not a permanent loss. When you lodge your annual tax return, the ATO averages your actual total income and reconciles what you’ve paid. Most people who have “over-taxed” high-earning weeks end up with a refund, because their average income for the year is lower than those big weeks suggested.

Common Real-World Mistakes With Weekly Tax Tables

- Misusing the tax-free threshold: The tax-free threshold ($18,200 for 2025–26) should only be claimed on one job—typically your main or highest-paying job. Claiming it on multiple jobs means not enough tax is withheld overall, leading to a bill at year-end.

- Using the wrong pay-period table: Employers sometimes set up payroll using the weekly table when they actually pay fortnightly, or vice versa. This throws off the withholding calculation because the tables are calibrated differently.

- Forgetting special cases: Employees with HELP or other study loans need extra withholding via a separate table. Foreign residents don’t get the tax-free threshold. Employees who don’t provide a TFN are withheld at 47%. Each of these requires a different table or adjustment.

Casuals, Variable Hours and Second Jobs – How the Weekly Table Really Works

- Casual employees with fluctuating hours: If you work 40 hours one week and 15 the next, the table withholds more tax in the big week and less in the small week. Over the year this usually evens out, but your weekly take-home swings. In contrast, employees who receive regular payments on a weekly basis will have consistent withholding using the weekly tax table. If you also have a HELP debt, the study and training support loans table adds extra withholding on top.

- Employees with multiple jobs: Each employer calculates PAYG independently. Your main job should claim the tax-free threshold; all other jobs should use the “no tax-free threshold” column. If you forget to tell your second employer, they’ll under-withhold and you’ll likely owe money.

- Practical tip: Check a few payslips each year to confirm your employer is using the right table and column. Compare the tax withheld line to the ATO weekly tax table for your gross pay and threshold choice.

For Employers and Payroll – Getting PAYG Right Using Weekly Tables

Employers have a legal obligation to withhold the correct amount of PAYG tax. Quick checklist:

- Confirm PAYG withholding registration with the ATO before you hire your first employee.

- Collect a valid TFN declaration from each new employee, including their tax-free threshold choice, foreign residency status, and whether they have a HELP or other study loan.

- Use the correct pay-period table that matches how often you pay.

- Update tables each July from 1 July or whenever the ATO announces mid-year rate changes.

- Handle edge cases carefully: 53-pay years, back pay, bonuses, leave loading, and foreign resident employees all require special treatment under PAYG rules.

- Be aware of Medicare levy adjustments and Medicare levy variation declarations: Some employees may need a Medicare levy adjustment or to lodge a Medicare levy variation declaration to ensure the correct amount is withheld, especially in cases involving surcharge tests or special tax scenarios.

Payroll software usually auto-updates tables, but spot-check a few calculations manually or via the ATO tax withheld calculator to confirm the system is correct.

Weekly Tax Tables as a Cash-Flow and Planning Tool

Beyond compliance, the weekly tax table is useful for planning after-tax income. If you’re buying a property, banks assess your loan serviceability based on net income. Running your gross pay through the weekly table gives you a realistic estimate of take-home pay.

For property investors or side-hustlers who earn wage income plus rental or business income, correct PAYG withholding on wages helps smooth cash flow. Tracking expenses and understanding how taxes on different income sources impact your overall financial planning are crucial for optimising your budget and avoiding surprises at tax time. If you under-withhold on wages, you might face a big bill when your investment income is added at tax time.

Understanding the weekly table also helps you model scenarios: “If I pick up extra shifts, how much extra will I actually see after tax?”

Fixing Problems – What If You’ve Been Using the Wrong Table or Column?

If something’s wrong—you’ve been claiming the tax-free threshold on two jobs, or your employer has been using the wrong table—here’s what to do: Taxpayers should regularly review their payslips and withholding to ensure accuracy and avoid surprises at tax time.

- Check your payslips against the current ATO weekly tax table.

- Talk to your employer or payroll team as soon as possible. Provide a new TFN declaration if your circumstances have changed.

- Understand the tax-time impact: If you’ve under-withheld all year, you’ll owe money when you lodge your return. If you’ve over-withheld, you’ll get a refund.

The weekly table error doesn’t change your total tax for the year, just the timing of when you pay it.

Automating Weekly Tax Calculations

Most modern payroll software (Xero, MYOB, KeyPay) and the ATO’s own tax withheld calculator automate the weekly tax table lookup. The software updates tables automatically when the ATO releases new rates.

Periodically spot-check the software’s output against the current weekly tax table. Set a reminder each July and whenever the ATO announces a mid-year rate change. Run one or two sample pays through the ATO calculator and compare to your payroll system.

Other Tax Tables and Publications

The ATO’s got a fantastic range of tax tables and publications to help you nail the perfect amount of tax to withhold from your employees’ payments! You’ll find loads of options beyond just the weekly tax table – there are brilliant PAYG withholding tax tables for fortnightly and monthly pay periods, plus heaps of other tax tables for those tricky situations like foreign residents, irregular payments, and additional levies.

You’ll want to make sure you’re always checking out the most current ATO tax tables and publications – trust me, it’s worth it to ensure you’re using the right table for each employee’s pay frequency and circumstances.

The ATO’s tax withheld calculator is an absolute gem for double-checking your calculations and confirming you’ve got the correct amount of tax to withhold. And don’t forget about getting your head around the tax-free threshold, tax brackets, and applicable tax rates – they’re absolutely essential for spot-on withholding!

By consistently using the right tax tables and sticking to those ATO guidelines, you can be totally confident that you’re withholding exactly the right amount of tax from your employees’ payments.

Why not reduce the risk of compliance headaches and help your employees manage their tax obligations smoothly throughout the year? It’s a win-win situation that’ll keep everyone happy and stress-free!

Key Takeaways

- The weekly tax table is an ATO tool that tells employers how much PAYG withholding to take out of weekly wages for a given income year, not the employee’s final tax bill.

- Using the correct, current-year weekly table (and the right pay-period table overall) helps avoid large year-end tax bills or unexpectedly big refunds.

- The biggest real-world errors come from the tax-free threshold, multiple jobs, casual/variable hours, and special cases like HELP/STSL debts, foreign residents and no-TFN situations.

- Employees and employers should set up a simple system: rely on updated ATO tables or calculators, automate through payroll software where possible, and spot-check a few payslips each year.

- If income is complex (multiple jobs, investments, foreign residency), the weekly table is only a starting point and getting professional advice can prevent compliance issues and cash-flow shocks.

When to Get Professional Help

If your situation involves multiple jobs, foreign residency, significant investment or business income alongside wages, or HELP debts combined with variable casual income, the weekly tax table is only one piece of the puzzle. A tax adviser or accountant can help you set up the right PAYG withholding, lodge variations if needed, and plan for year-end tax obligations so you’re never caught short.

The weekly tax table is a practical compliance tool, but it’s also a window into how the Australian tax system handles timing and estimation. Getting it right week by week means fewer surprises in July, better cash flow, and more confidence in your overall tax position.

Contact our team to see how we can help you with your payroll headaches.

Frequently Asked Questions About Weekly Tax Tables

Do weekly tax tables include the Medicare levy?

Weekly tables are built from the income tax scales, which assume the standard Medicare levy settings for most residents; separate ATO guidance applies where Medicare levy reductions or exemptions are claimed. No medicare levy adjustments are made during the standard withholding process unless a valid variation is lodged.

Do weekly tax tables include tax offsets?

Basic offsets can be reflected via the ATO “ready reckoner” that converts an annual offset to a weekly reduction in withholding, but this requires the employee to lodge a valid withholding declaration.

Which table should I use if I pay staff fortnightly or monthly, not weekly?

You must use the ATO tax table that matches the actual pay period (weekly, fortnightly or monthly) rather than trying to “convert” from the weekly table yourself.

Why was I taxed so much in one high-earning week?

The weekly table assumes that week’s pay continues all year, so overtime or big bonus weeks are withheld at a higher rate, which is usually reconciled at tax time through a refund.

How do weekly tax tables work if I have more than one job?

Typically the tax-free threshold is claimed only on your main job; second and later jobs should use the “no tax-free threshold” settings so overall withholding is closer to your final annual tax.

Where can I find the latest ATO weekly tax table?

The current-year weekly tax table (NAT 1005) is available on the ATO website under the tax tables section, along with PDFs and related guidance for employers and payroll software.

Are there special tax tables for performing artists and workers in the horticultural industry?

Yes, the ATO provides specific tax tables for payments made to performing artists and workers in the horticultural industry. Employers must use these tables to ensure correct withholding for these categories.